are political donations tax deductible uk

If you are not tax exempt and contributed charitable donations to a qualified organization you could claim a tax deduction. Regardless of what type of political.

Do 100 Of Donations Really Go To The Charity

Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible.

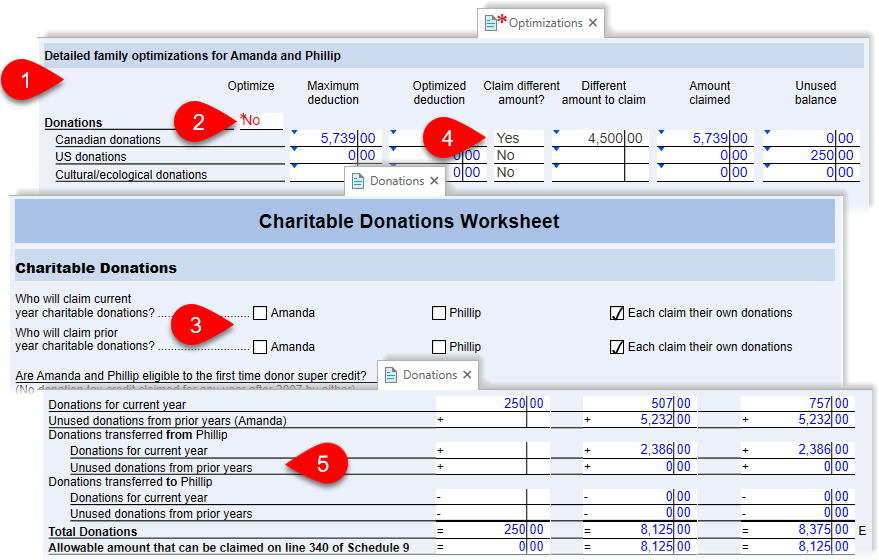

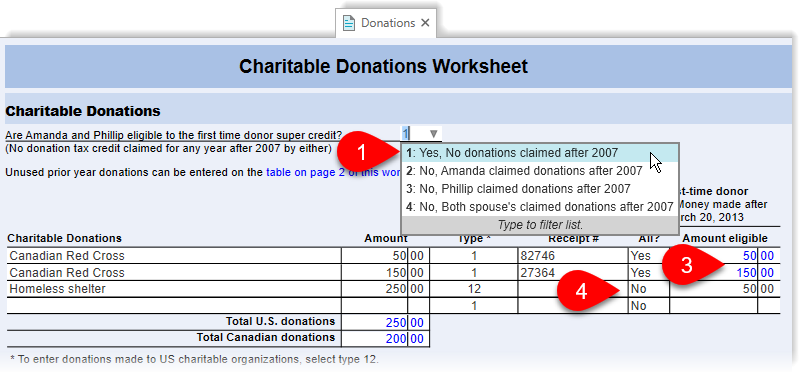

. Subscriptions for general charitable purposes and those to for example political parties are. Is donation to political party tax deductible. Under the Political Parties Elections and Referendums Act 2000 PPERA which governs donations to political parties any contribution of more than 500 must come from a UK-based individual or.

1500 for contributions and gifts to independent candidates and members. Political Donations Are NOT Tax Deductible. The IRS has clarified tax-deductible assets.

According to Intuit by TurboTax political contributions arent tax-deductible While charitable donations are generally tax-deductible any donations made to political organizations or. Money that you may. Are political donations tax deductible uk.

Even though you cant deduct political donations as charitable contributions on your federal return doesnt mean all is lost. Among those not liable for tax deductions are political campaign donations. The amount of the deduction for a contribution or gift of property is either the market value of the property on the day the contribution or gift was made or the amount.

The simple answer to whether or not political donations are tax deductible is no. In other words you have an opportunity to donate to your candidate. Zee March 2 2022 Uncategorized No Comments.

The most you can claim in an income year is. Money that you contribute to a person campaign or political party is not tax deductible. Political donations are not tax deductible on federal returns.

To put it another way financial. Things To Know. A donation to a federal state or.

As of 2020 four states have provisions for dealing. Are Donations to Political Campaigns Tax Deductible. In general you can deduct up to 60 of your adjusted gross income via charitable donations 100 if the gifts are in cash but you may be limited to 20 30 or 50 depending.

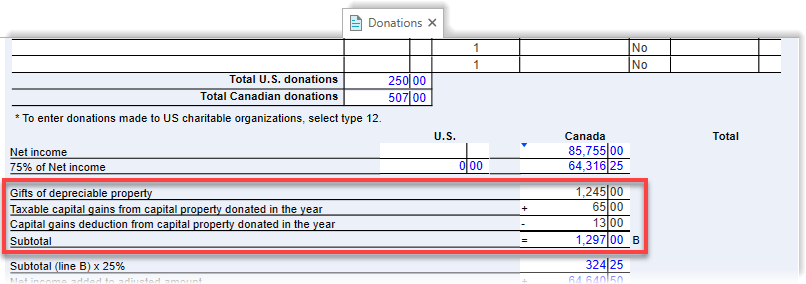

While charitable donations are generally 75 of contributions up to 100. A business tax deduction is valid only for charitable donations. 1500 for contributions and gifts to political parties.

S341 Income Tax Trading and Other Income Act 2005 S541 Corporation Tax Act 2009. These donations are not tax deductible. Money donated to political campaigns or any aspect related to these campaigns and politics generally is not applicable for tax deductions.

However in-kind donations of. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. However there are still ways to donate and plenty of people have been taking advantage of them over the past.

List Of Best Ngos In India Genuine List Of Top Charitable Org Ngos Smile Foundation Social Work

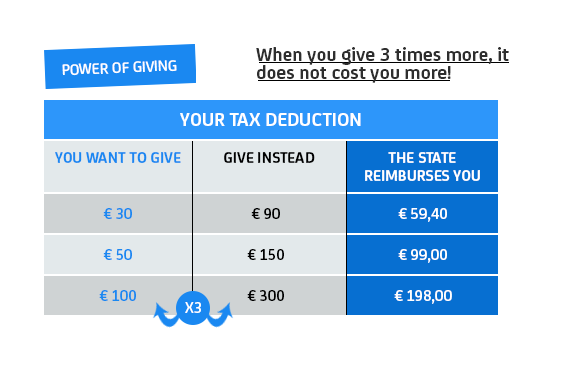

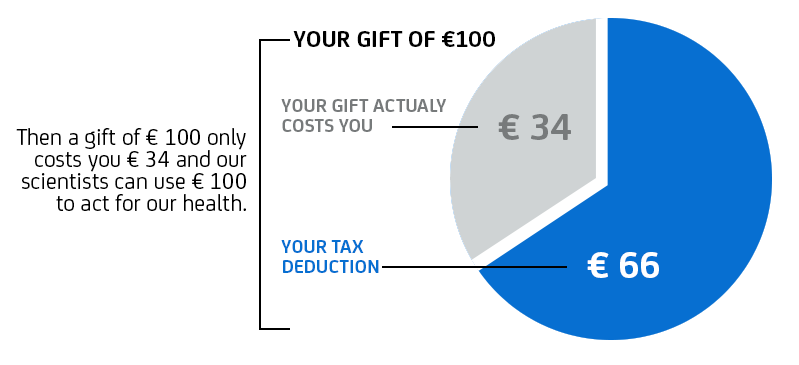

Tax Deductible Donations Institut Pasteur

How Much Should You Donate To Charity District Capital

Did You Know That Your Clothing Donations Can Lead To A Tax Deduction Here S How To Get Rid Of Un Us Donation Tax Deduction Tax Deductions Tax Deductions List

Tax Deductible Donations Institut Pasteur

Tax Deductible Donations Can You Write Off Charitable Donations

New Tax Regime Disincentivises Charity Donations Says Study Business Standard News

Tax Deductions For Donations In Europe Whydonate

Nonprofit Tax Programs Around The World Eu Uk Us

Canadian Tax Return Check List Via H R Block Ca Http Www Hrblock Ca Documents Tax Return Do Small Business Tax Deductions Business Tax Tax Prep Checklist